I'm having a chuck of aluminum coming in from States through DYK, so they will ask me for a duty code. It is an offcut. I'm not clear what defines a scrap. Does anyone know what tariff code would be applicable.

I get different results depending on where I search & another factor might be the tit-for-tat USA/CAN tariff headaches which could either be old news or still in play FAIK

Strangely my eye is drawn to classifications that suggest zero

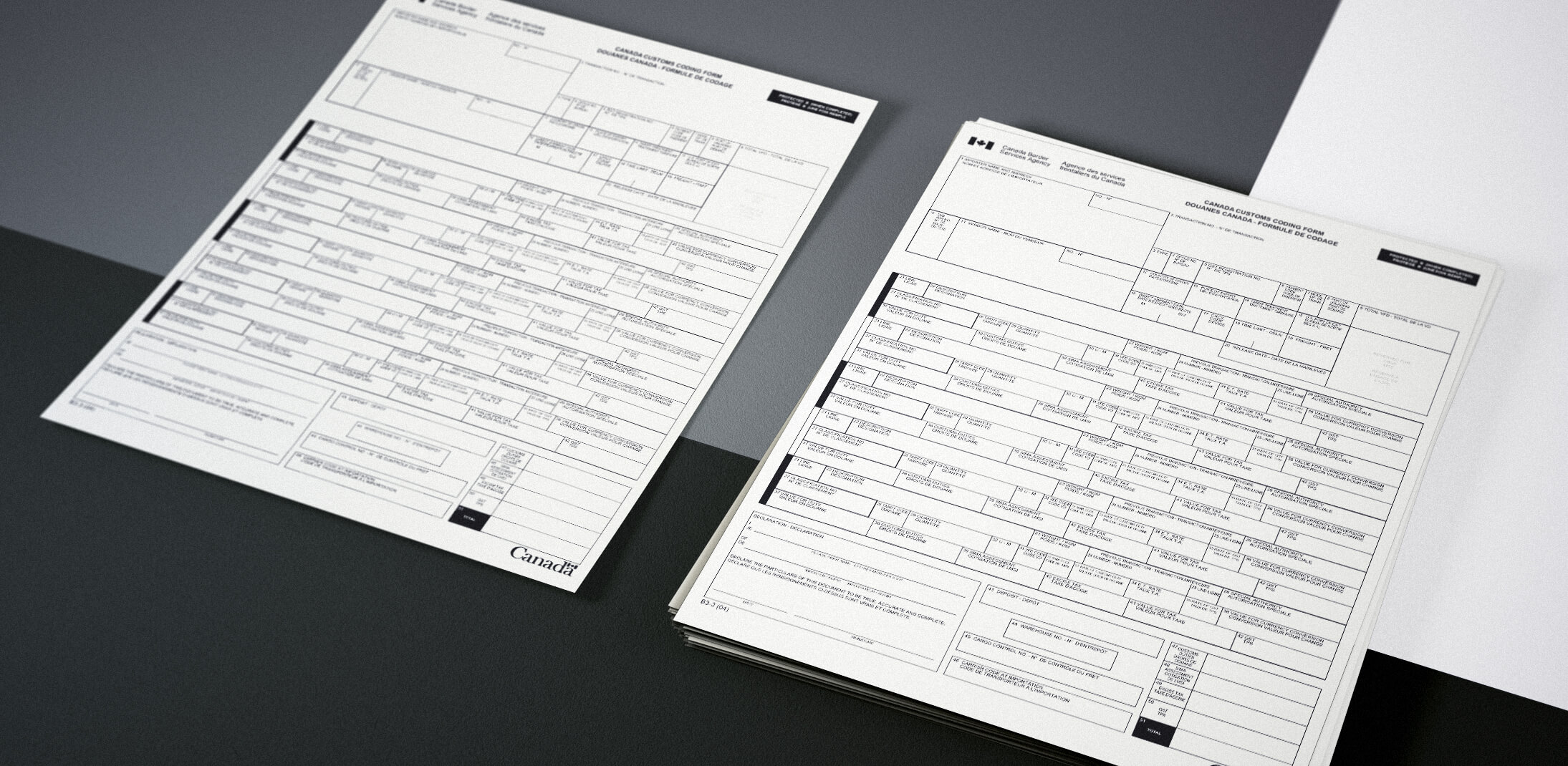

www.cbsa-asfc.gc.ca

www.cbsa-asfc.gc.ca

www.cybex.in

www.cybex.in

I get different results depending on where I search & another factor might be the tit-for-tat USA/CAN tariff headaches which could either be old news or still in play FAIK

Strangely my eye is drawn to classifications that suggest zero

Chapter 76 : T2022

2022 list of preferential tariffs for products coming from countries with which Canada has a free trade agreement based on the World Customs Organization’s Coding System.

HS Code List | India Harmonized System Code | HS Classification

Free Search HS Codes, Indian Hs Code List, ITC Harmonised System Code, HS Classifications, Search HS Code in Chapter 1 to 98, Custom Tariff Head